Do I Need Insurance for a Digital Marketing Agency?

As a digital marketing agency owner or a marketing consultant, you might wonder if insurance is anything your business will need to endure. But the risks, with everything around you changing and shifting within the digital landscape, run uniquely in an agency of marketing or a firm which offers marketing consultancy. From data breach to copyright infringement, the digital world brings with itself unique forms of threats and perils no traditional insurance covers. That’s when this particular insurance kicks in-known as digital marketing insurance.

A digital marketing insurance article for agencies and consultants will cover the essentials of why insurance is necessary, what types are available, and help you determine what you may need. This guide will provide you with the insight on why, whether you’re working at a small startup or managing a huge marketing firm, insurance can serve as a surety to shield your business against uncertainty.

Why Does a Digital Marketing Agency Need Insurance?

The nature of digital marketing involves handling sensitive client information, running complex campaigns, and reliance on technology. Such factors bring along tons of intrinsic opportunities for success but also tons of intrinsic risk. Here are some reasons why digital marketing businesses need insurance:

- Cyber Risks and Data Breaches: When handling digital marketing, data will be one of your most expensive assets that you will handle. This simply means managing clients’ sensitive information, for example, pay details or personal details and customer insights. Loss of the information may lead to some of the most significant reputational and legal fallouts, further influencing profitability in a business. Cyber liability insurance is therefore one of the key types of coverage necessary in recovering from financial loss caused by this.

- Client lawsuits: However careful and professional you are, there is always a risk of encountering a lawsuit. Clients can sue for negligence, error on your work, or breach of contract. The legal fees and costs of reaching out to a settlement can be substantive quickly. Professional liability insurance, also known as Errors and Omissions insurance, is the protection of the agency from being sued because of a mistake or failure on your part through services.

- Intellectual Property Infringement: Digital marketing is about creating content, blog posts, videos, advertisements, and graphics. Imagine a client files an action against you for infringement of their intellectual rights or you really violated copyrighted material. Of course, you will be legally battered. There are some areas where general liability insurance may be beneficial in helping mitigate the risks associated with copyright and trademark infringement claims.

- Business Interruption: Unexpected events like storms, equipment failure, or other business interruption can be a temporary stop to your activities. With business interruption insurance, you can carry out your sustenance business even in the most trying times. Business property insurance and business interruption are riches in income if things turn bad.

- Reputation Risk: In an extremely competitive industry such as digital marketing, reputation is everything. A lawsuit or major data breach can crush the faith of clients. Being insured under a digital marketing agency can equip a business with various legal defenses or settlements and other financial support in defense of one’s reputation.

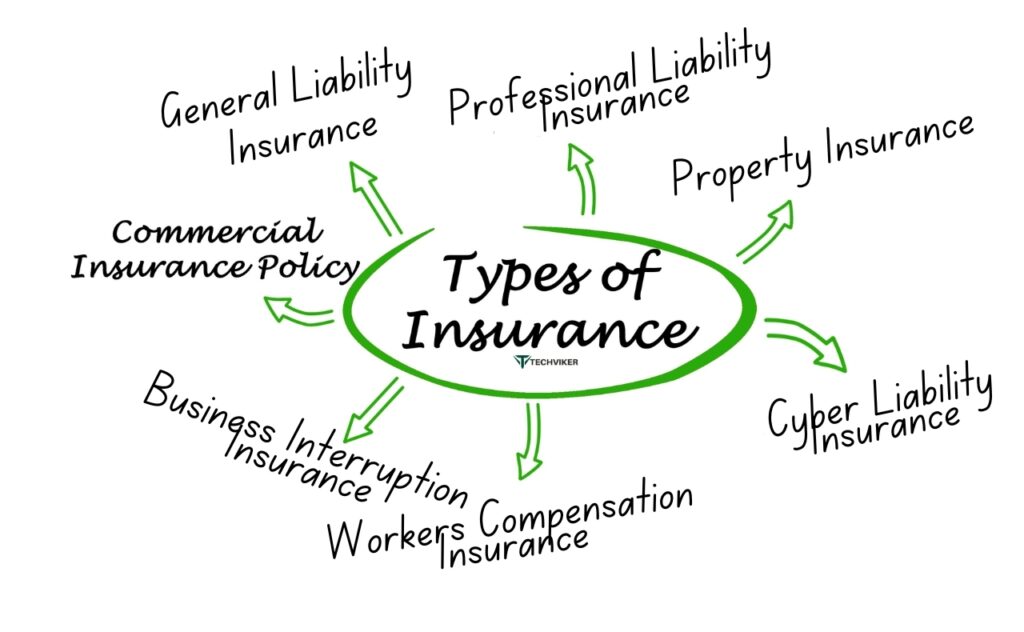

Types of Insurance for a Digital Marketing Agency

While you are evaluating insurance covers for your marketing business, it would be better if you could explicitly analyze what risks your agency encounters. For that reason, here are the major kinds of insurance coverage you should consider.

1. General Liability Insurance

All businesses, including a digital marketing agency, have general liability coverage as a standard insurance policy – one that protects the business from any request made by a third person in any of three major areas; bodily injury, property damage, or advertisement malefactions that include defamation and libel. For instance, if your company organizes an event and someone gets hurt during that event, or if a customer complains that one of the advertisements did a disservice to their brand. Such insurance protects companies from having to pay for any defenses against settlement claims, in this case, legal complaint expenses.

2. Professional Liability Insurance/Errors and Omissions Insurance

You rendered your professional expertise and performed functions as a consultant or advertising agency for the client. When such advice or execution of such services leads to damages of losses in some amounts or even physical damages for the client, you are most likely to be sued for, negligence or for having breached the terms of a contract. Protecting any agency against any third-party claim or lawsuit (or both) is the reason why E&O insurance, also referred to as professional liability insurance, is very important. That is, this insurance will pay for your lawyer’s legal fees and all the settlement amounts in addition to the debt awarded during the suit against you.

3. Cyber Liability Insurance

The reason is that your business is digital and therefore threats of a cyber nature are one of the most dangerous threats to your business. A simple data breach a hacking attack or malware could disrupt your business, leaving you with real loss. All these data breaches, cyber-attacks and other cyber risks causing interruptions to business operations will be covered under cyber liability insurance. For instance, loss of client data, cyber-attacks leading to loss of reputation, and even regulatory body penalties.

4. Workers Compensation Insurance

If you have employees or independent contractors working for you, then workers compensation insurance is usually mandated by state law. Workers compensation in the event of a job-related injury or illness will cover medical expenses, lost wages, and rehabilitation costs. Even if you are just running a solo consultancy, you might benefit by covering this because sometimes you work with other contractors or subcontractors.

5. Property Insurance

Running a digital marketing agency at times means purchasing equipment like computers, software, and office furniture. When those assets get damaged or stolen, the property insurance will replace them. This therefore covers your business needs since this covers the physical property you rely on to do business.

6. Business Interruption Insurance

Commercial interruption insurance will help cushion lost income and operating expenses if your office experiences a disaster, such as a fire or natural disaster. For agencies dependent on a smooth flow of income, this can be the very means of avoiding extreme financial pressures when unexpected events crop up.

Determining Your Requirements

Risk assessment Before getting insurance for your digital marketing agency, you need to assess the risks. You should check the scope of the business and probable risks involved. Consider these factors:

- Size of your business: are you a one-man consultant, a small-sized agency, or a large firm?

- Nature of services: do you handle sensitive data, create intellectual property, or you offer marketing advice?

- Risk for cyber threats and legal disputes

- Local and state regulations for acquiring business insurance

You will know exactly where to look for the right coverage according to your specific risks. Get a reputable marketing agency insurance agent who specializes in this kind of insurance for marketing agencies.

Legal Requirements for Digital Marketing Insurance

Based on the location and size of your business, so will your legal requirements. You will be required to obtain certain insurance in some states. Workers’ comp, general liability, or even other related insurance types may be necessary for your specific business. You should be aware of the business insurance requirements within your state.

For example, some clients might request to be provided with proof of insurance before they go ahead and start using your agency. Digital marketing insurance aids in meeting legal requirements but also provides your potential clients with credibility.

Future Trends of Digital Marketing Insurance

The rising concerns with regard to risks associated with the dynamics of the digital marketing sector include unintended challenges such as AI-associated errors and potential failures associated with automation. Altogether, the growth in constraints on online privacy raises a concern about increasing scrutiny and liability associated with handling client data on the part of digital marketers.

It should then become a step forward for the emerging risks of the digital marketing agencies; they should keep checking on their insurance needs continually and thus fully cover all aspects. This will ensure you are shielded in the long run and stay ahead of the curve in both digital marketing and insurance trends.

Conclusion

Indeed, with the fast-paced and ever-risk-filled digital environment these days, insurance for digital marketing will no longer be one of those nice-to-have things but rather one that you need to have. Not only would it protect your marketing agency from litigations, data breaches, cyber threats, and all forms of challenges that may jeopardize your business, but it would also protect your business in the face of really threatening marketplace conditions. Make sure you do all of the above by taking marketing agency insurance, including errors and omissions, general liability, and cyber liability.

Small and large digital marketing firms will benefit when they secure business with the right insurance. You are assured of peace of mind and ensure that your agency prospers tomorrow by taking preventive measures today.